Accuracy Explanation:

TAX METHOD (THE WRONG WAY)

Automated valuation models have been around for some time. Their accuracy is frequently in question. The reason for this is that almost always, county tax assessment information is used as the base for the model. This is the easy information to obtain about a property but reflects the purpose of property assessment - not market value. The assessed value is then used as the base to calculate the current market value. At best, these models can only be as good as the assessed value and in practice, are worse.

COMPRAISER METHOD (THE RIGHT WAY)

Compraiser does it right. Compraiser:

- Does not use distressed (e.g. foreclosures) properties to determine market value

- Was developed by real mathematicians and Real Estate Professionals

- Updates new sold data EVERY day

- Gives you information that no other AVM has!

DATA USED

In December of 2007, an intensive audit was conducted to determine the relative accuracy of Compraiser.

The audit:

- Calculated the compraiser value on the sold date for every sold property in the WFRMLS in 2007 in Salt Lake County

- Cleaned up the county assessor data to ensure accurate results

- Caculated the 'best fit' multipliers for an AVM based on assessor data to give the best possible model to compare against Compraiser

- Calculated the mean and standard deviation for each method

- Standardized the information for understandable reporting

The results are displayed below.

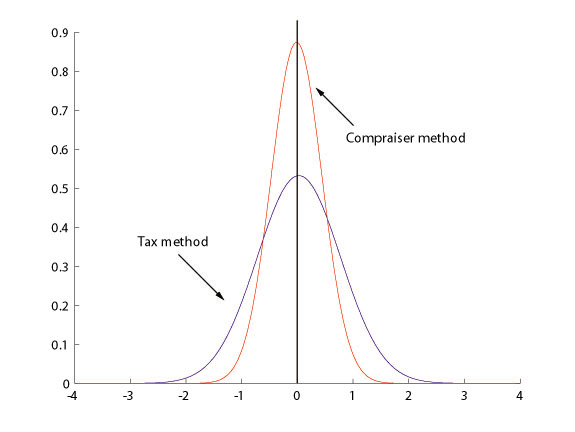

VISUAL DISPLAY

Taller and thinner graphs indicate the better model. The perfect model is a straight line going up at 0.

CONCLUSIONS

The Compraiser model is far superior to the 'best possible' AVM model based on assessor data.

We are proud of what we have accomplished so far and are focused on continual improvement of the model.

No model is perfect. But Compraiser always yields valuable information about real estate in an area.

For example:

- Properties that are sold artificially high (perhaps through fraud) will skew the Compraiser numbers. For an example of what actual fraud looks like in a Compraiser report, click here

- Trends can even be more informative than current market value. To visually 'see where the value is heading' is something that is not available with other models.

- You can see the year-over-year rate of return of the property

Whether buying, selling, contesting taxes, or just finding out what is going on in the area, Compraiser is the model that makes sense.

Your input is always welcome and your loyal support is appreciated!